HALLO ALL, THIS TIME WILL EXPLAIN ABOUT CREDITO

Credito is a decentralized credit intelligence network providing credit scores, transaction scores and lending marketplace powered by Ethereum blockchain, Smart Contracts and IPFS, bringing enhanced transparency and reliability.

Credito brings Financial Inclusion to the "Credit Invisibles" by providing accurate and reliable credit scores.

According to a 2016 report by Nilson, losses from credit card fraud amounted to $21.8 billion in 2015 that’s an increase of 162% from the 2010 figure which was $8 billion. The losses for 2016 are already estimated at over $24 billion, and these losses are expected to reach $31 billion by 2020.

The total value of credit and debit card transactions was $31 trillion in 2015. While the total value of credit card transactions is growing at close to 7 percent a year, credit card fraud is growing at over 16 percent every year.

These losses occur throughout the system, including at the point of sale, at ATMs, and during online transactions. While EMV chip technology has reduced the incidence of in store fraud, it does not help with online fraud.

On the other hand, peer to peer (p2p) platforms are among the fastest growing segment in the financial services space. By Transparency Market Research suggests that “the opportunity in the global peer-to-peer market will be worth $898 billion by the year 2024, from $26 billion in 2015. The market is anticipated to rise at a CAGR of 48% between 2016 and 2024. The market for alternate finance gained popularity in recent years.

While the growth projections for p2p lending are promising, one of the major challenges is providing a system to reduce fraudulent and high risk activities, as they result in loss of investor confidence and trust.

Challenges:

Monopoly

Security

Centralized Information

Portability

Outdated Analytics and Incomplete information

Solution

i. Transparent

ii. Loan Agreements are Smart Contracts

iii. Trustless

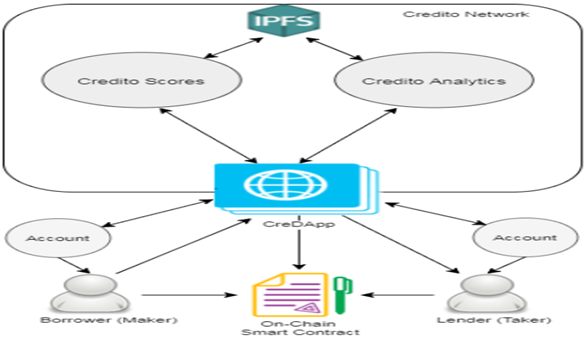

As a solution to the above problems, we have created the Credito Network, or simply Credito. A decentralized network based on Ethereum blockchain coupled with smart contracts and Interplanetary File System (IPFS5) providing Credit Intelligence and Decentralized Lending Marketplace.

Credito encourages the expanding and proficient operation of the credit industry by permitting both fiat and digital resource loan specialists to broaden credit to people and establishments with underdeveloped or a juvenile credit framework. The ecosystem provides solutions to enable any verified lender to safely and securely issue credit to the verified borrower.

Decentralization provides more security and trust. It is a method to organise anything in a way that does not require trust on third parties. The trust is eliminated by executing code that does not require centralized governance, management, or servers. By decentralizing lending, we do not require banks or any other intermediaries for conducting a loan transaction.

Decentralization through the use of Smart Contracts also removes any trust requirement between borrowers and lenders, providing a trustless and transparent lending environment unavailable in today’s market.

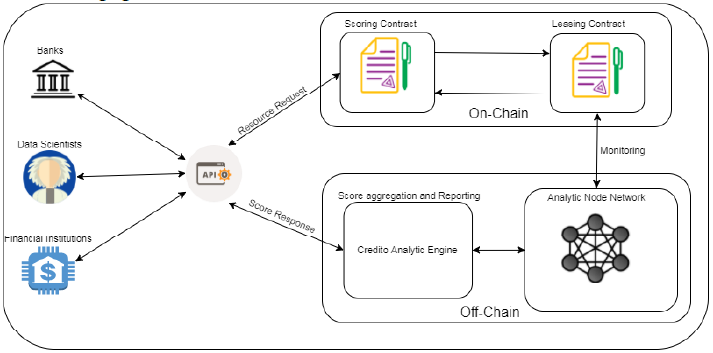

The Scoring Contract has 2 primary functions:

Responding to individual credit score requests

Validating third party transaction scoring requests. Moreover, it also keeps track of the credits balance and usage metrics.

For any given analytic node, the Leasing Contract monitors the following metrics:

• Total number of assigned requests: The total number of past requests that a node has agreed to, both fulfilled and unfulfilled.

• Total number of completed requests: The total number of past requests that a node has fulfilled. This can be averaged over number of requests assigned to calculate completion rate.

• Average time to respond: The timeliness of the node’s responses which is an indicator of the nodes efficiency. Average response time is calculated based on completed requests.

• Node reputation: The reputation of the node based on previous scored transactions. All nodes verify and vote each other’s scores, if the majority of the nodes return an identical value, the node become trustworthy. This reputation system helps to identify and remove faulty nodes from the network.

The loan agreement process:

Maker creates a credit order in the CreDApp requesting a loan by pledging Token A as collateral for Token B, specifying a desired interest rate, LVR, expiration time, and signs the request.

CreDApp attaches the dynamic Credito report of the Maker to the request, verifies the Maker has enough Token A and freezes them until the loan is serviced or the credit request expires, and broadcasts the request over Credito.

Taker intercepts the request and decides that they would like to fill it.

Taker submits the makers signed request to the Credito with his signature.

The Credito authenticates Maker signature, verifies that the request has not expired and has not already been fulfilled, then creates a smart collateral management contract by transferring the collateral to the smart contract.

CreDApp stores and executes the smart contract on Ethereum blockchain and Token B will be transferred from Taker to Maker.

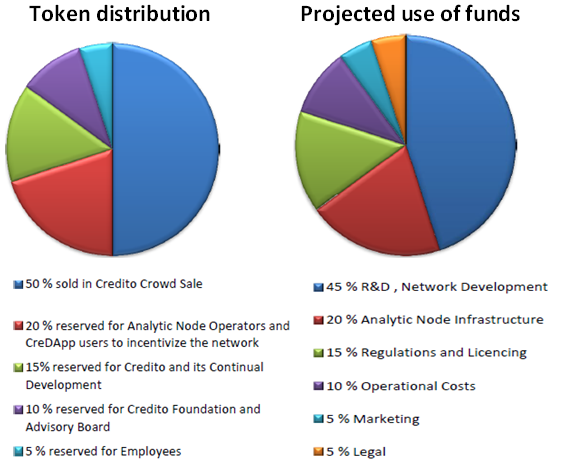

Token Distribution

In order to undertake further development, Credito will conduct a one-off Token Generation Event (“TGE”) and crowd sale of Credits, where 50 % of the Tokens will be made available for public sale. The start date of the TGE will be announced soon, and it will allocate a total Credits supply of 1 billion as follows:

FOR MORE INFORMATION CLICK ON LINKS BELOW:

Official Website: https://credito.io/

Whitepaper Link: https://credito.io/pdf/whitepaper.pdf

Telegram Channel: https://t.me/CreditoCommunity

Official Facebook Page: https://www.facebook.com/CreditoNetwork

AUTHOR:Damkar58

Tidak ada komentar:

Posting Komentar